Do you need help with unpaid invoices?

The good news is that the law is on your side. And if you charge the appropriate late payment fees, collecting the invoice may not cost you anything.

As experts in B2B debt recovery, we’re well-placed to help you through the process. This guide explains exactly what we recommend to our debt recovery clients.

No Cost. No Obligation.

100% Confidential.

Table of Contents

1. When to Get Help With Unpaid Invoices

Many businesses ask us when to begin unpaid invoice recovery. The short answer is that you should contact us for a free review of your claim as soon as you feel you’ve exhausted other options, like late payment reminder letters.

Many businesses chase invoices for too long, either because the client makes promises they don’t keep and drags things out, or because the person chasing is worried about souring the business relationship if they push for money.

Remember that you are entitled to be paid. And a good client will give you timelines that they actually stick to. Yes, it’s possible that mistakes can be made, and when that happens, you should allow a little more time.

But if your invoice is unpaid and you also notice:

- The client is dodging emails

- Nobody is returning phone calls

- Payment deadlines are repeatedly missed

…these are all signs that your client may not be enthusiastic about paying you.

In general, it is much easier for us to recover an unpaid invoice when you contact us quickly. Even if you decide not to recover the debt immediately, older debts are more difficult to prove, and therefore recover.

2. Double-Check Your Invoice

Before chasing your unpaid invoice, check that you haven’t made a mistake with the amount, dates, or recipient email addresses.

Invoicing a small business or a freelancer is usually fairly simple. But large companies typically have set requirements on things like:

- Specific recipients

- Timing

- Reference or PO numbers, including where and how they’re displayed on the invoice

Check everything against your contract, payment terms, or previous emails and make sure it’s correct.

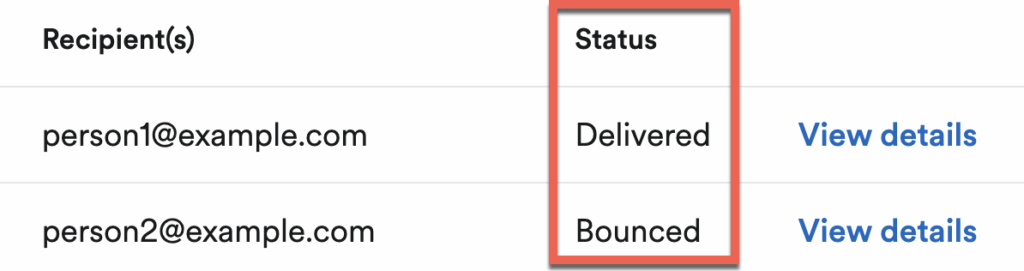

If the email addresses look right, it’s also a good idea to see if the invoice was delivered successfully, which is supported in some accounting platforms. As an example, FreeAgent allows you to see who received the email and whether the status is Sent, Delivered, Bounced, or Blocked.

Bounced may indicate an issue with the invoice email address, like a full mailbox or a typo. If your email was blocked, that might give you an important clue about what is happening with your client.

Either way, catching these issues now means you may have an explanation for the late payment, and you can sometimes rectify the problem without the need to chase.

3. Call Your Client About Payment

Whether your invoices are blocked or not, the next step is to pick up the phone and call your client to ask about the status of your unpaid invoice.

In our experience, administration is the cause of many past due invoices because:

- Emails get deleted or delivered to spam folders

- Invoices get lost in files

- Your email gets blocked

- People simply forget to pay you on time, which happens to the best of us

So if your unpaid invoice is only slightly overdue, we’d recommend calling first to politely ask for a payment date. This is also true if you’ve worked with a client for a long time and they usually pay you without any problems. An admin error may be to blame.

How to Chase an Invoice Over the Phone

When you chase an invoice over the phone, keep your tone light and professional. Even if you’re stressed, it’s important to maintain good relations at this stage.

Profitable business relationships are built on personal relationships, so it can feel tricky to pursue what is owed without causing bad feelings on a personal level.

If you don’t feel comfortable calling clients about late invoices, you can hire a virtual credit controller to do this for you.

Here’s a phone script you can use when you call to chase the invoice:

- Remind your customer that the unpaid invoices in question are now past due

- Tell them that you would appreciate payment as soon as possible.

- Ask them when you can expect the payment to be made – get an exact date if you can.

- Confirm the client has everything they need from you to process payment without further delay.

If your client has genuinely made an error, your phone call will likely secure payment.

Follow up with an email that lists the answers to each question so you have a written record.

What Happens if the Client Has an Issue With the Work or the Invoice?

If your customer has a legitimate query or question regarding the invoice, they can tell you there and then, and you can act quickly to resolve it.

If this happens, make a note of the conversation. You might want to follow up with a quick, friendly email to confirm what they said and what you’re going to do next.

Once the query is resolved satisfactorily, repeat the process:

- Call again

- Use our script, just as you did the first time

- Confirm the issue is resolved

- Ask them to confirm when payment will be made.

In most cases of late payment of unpaid invoices, this will be all you need to get paid.

What Should I Do If the Client Tries to Change Payment Dates or Terms?

If your client tries to change payment dates, and you have the original agreement confirmed, you are entitled to reject that. Read our guide to managing clients who try to dictate payment terms.

Remember that it’s a good idea to accept online payments to remove as much friction as possible. If you haven’t accepted card payments in the past, but your client is offering to make an immediate card payment to settle the overdue amount, think about how you’d accept it and whether it’s worth making an exception.

4. Send an Unpaid Invoice Reminder Letter

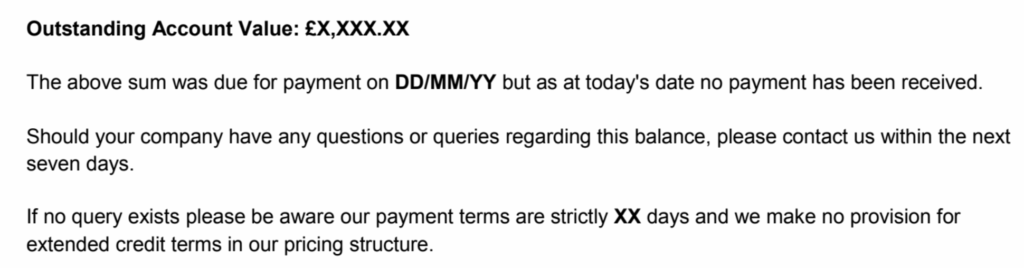

If your phone call doesn’t lead to payment of your unpaid invoice, your next step is a reminder letter. Rather than jumping straight to debt recovery, a letter from you shows them you know your rights.

How to Write Unpaid Invoice Collection Letters

We have three letters you can adapt and send. Check out free late payment letter templates.

The first letter is “The Nudge”. This is a gentle reminder, but it’s a step up from your phone call.

If you don’t get payment after that first chase letter, move on to letters 2 and 3.

The final letter is a final demand, which means the wording is slightly stronger. You should follow up on the final letter with a phone call to reinforce your intention to be paid.

If your client does not pay after that final letter and phone call, it’s time to get serious about debt recovery.

No Cost. No Obligation.

100% Confidential.

5. Check Your Client’s Credit Report

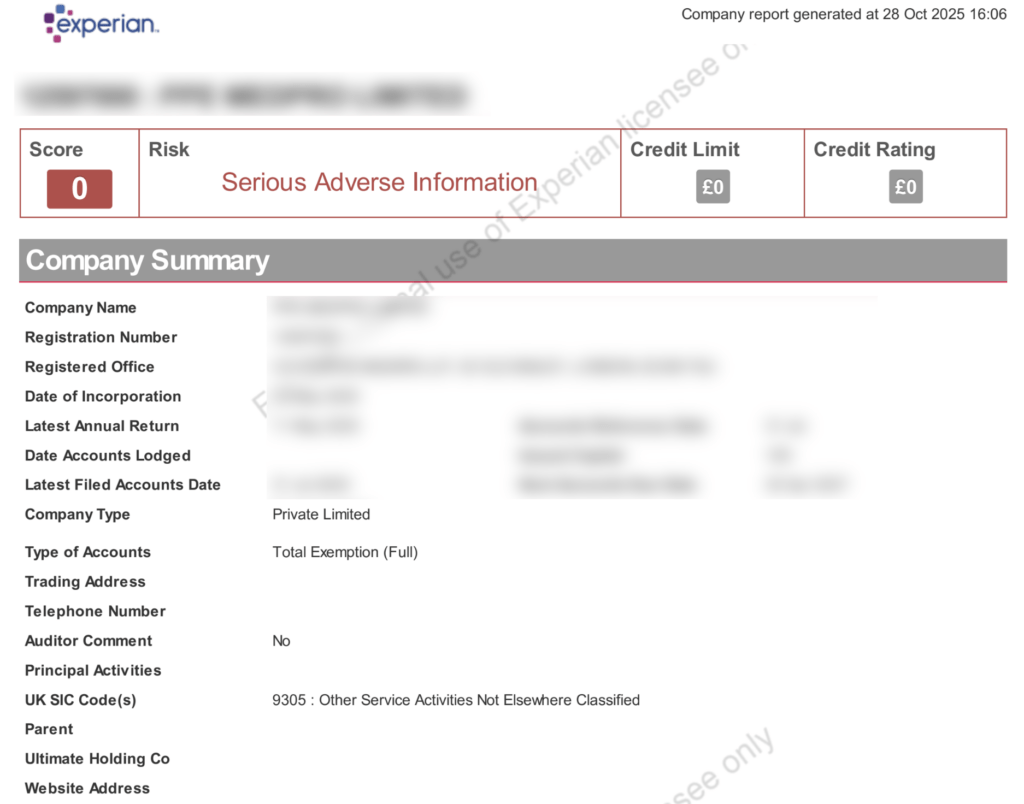

A business credit report can give you clues as to why your client is slow to pay.

Sometimes, credit reports reveal very obvious problems. Here’s an extreme example that shows the company has gone into administration.

You may see more subtle signs, such as a credit score that falls over time, or signs that the company has a complex structure that would make it harder to chase.

We have a guide to reading business credit reports to help you spot warning signs. If you see something that doesn’t look right, contact us immediately for a free review of your claim.

6. Calculate Interest and Penalties

UK businesses have a right to charge late payment interest and fees on top of the overdue invoice amount.

From the date your invoice went overdue, you can add on:

- Statutory interest at 8%

- Interest charged at the Bank of England base rate during the time your invoice was overdue

- Reasonable costs and fixed penalties

How to Calculate Interest and Fees on an Overdue Invoice

We have a free late payment fee calculator that you can use to calculate this right now.

It will instantly show you what you’re owed today once interest and penalty fees are added on. Here’s an example:

Calculating this in Excel can be quite complicated, depending on how long your invoice has been unpaid, so it makes sense to use the calculator to help you.

6. Research Unpaid Invoice Recovery Services

Now that you have a sense of what you’re owed, it’s time to look for debt collection services.

We strongly recommend doing your due diligence when selecting a debt collection agency to work with, since many can charge hidden fees or disappear with your money.

How to Find a Good Debt Collection Agency Online

When researching debt recovery agencies, look for:

- A long history in business debt recovery

- A proven track record

- No win, no fee collection (or, as we call our service: “no collection = no commission”)

- A positive brand reputation that you can verify through sites like Trustpilot

- A real business website that is actively maintained

Keep in mind that website testimonials may not be genuine, so don’t rely on reviews that the debt collection agency has published themselves. Instead, look for reviews on third party sites, like our reviews on Google:

Should I Look For No Win, No Fee Invoice Recovery?

Yes. We recommend that you use a no win, no fee debt recovery service.

Just keep in mind that no win, no fee can have hidden catches, and these firms can rack up unexpected costs.

Read through our guide to no win, no fee debt collection for the insider’s guide to this type of service. We’ve listed many of the hidden contract terms and unethical tactics that businesses sometimes use.

What If My Client Is Not in the UK?

Safe Collections works with a network of local agents in countries around the world. If you need international debt recovery, we have a proven track record of success.

Read this Safe Collections review from a contractor who did work for a company in the Netherlands. He engaged us to recover a debt that he was unsuccessful in recovering, even when engaging local lawyers. Our agent was able to recover the debt and resolve an issue with a non-compete clause that was blocking payment.

Again, act quickly if you need international debt recovery. Locating debtors in other countries is not impossible but becomes more difficult the longer you wait.

Get Help With Unpaid Invoice Recovery

Since 1984, Safe Collections has successfully recovered unpaid invoices for businesses in the UK.

We can also advise you on how the collection process will work in your unique situation.

For a free claim review without obligation, contact us today with your invoice details and payment date and we’ll get back to you with more advice.