When you’re working with international clients, you need to think ahead about the potential risks, including the very real risk of not being paid for the work you do.

When things go wrong, it can be difficult to resolve issues across borders.

Table of Contents

No Cost. No Obligation.

100% Confidential.

The 5 Main Risks of Working With International Clients

Working across borders introduces layers of complexity that don’t exist with domestic clients, and there are 5 main risks to consider.

- Legal recourse is more difficult and expensive if disputes arise

- Cultural differences can lead to misunderstandings about terms and expectations

- Payment mechanisms are more complex, with additional fees and delays

- Verifying a company’s legitimacy and financial health can be more challenging

- Communication barriers can obscure warning signs you’d normally spot

This guide will prepare you for common pitfalls and explain how to work efficiently with overseas clients.

Researching Your Potential Client Before Starting Work

It’s important to invest time into researching your client before entering into any new work agreement. The excitement of landing an overseas client can tempt you to move quickly, but skipping proper research at the start can lead to significant problems later.

Your strongest negotiating position is before you’ve delivered any work or incurred costs. Once you’ve invested time, resources, or money into a project, you’re already exposed to risk.

First, look into company verification and legitimacy. Does this company actually exist as a legitimate registered entity? It’s important to do your homework to avoid scams. Check the company registration with the relevant business authority in their country. Be wary of companies that are newly formed, have multiple recent name changes, or show directors with connections to dissolved companies.

| Country | Business Registration Authority | Website |

|---|---|---|

| Norway | Brønnøysund Register Centre (Brønnøysundregistrene) | brreg.no |

| Portugal | Conservatória do Registo Comercial / Commercial Registry (Registo Comercial – IRN) | registo.justica.gov.pt |

| Sweden | Bolagsverket (Swedish Companies Registration Office) | bolagsverket.se |

| Turkey | Trade Registry Office (Ticaret Sicil Müdürlüğü) / MERSIS system | |

| United Kingdom | Companies House | gov.uk/companies-house |

| Netherlands | Kamer van Koophandel (KVK – Netherlands Chamber of Commerce) | kvk.nl |

| Jersey | Jersey Financial Services Commission (JFSC) – Jersey Registry | jerseyfsc.org |

| Italy | Camera di Commercio – Registro delle Imprese | |

| Ireland | Companies Registration Office (CRO) | cro.ie |

| Iceland | Company Registry (Fyrirtækjaskrá) via Icelandic Tax Authority | skatturinn.is |

| Germany | Handelsregister (Commercial Register) | handelsregister.de |

| France | INPI (Institut National de la Propriété Industrielle) – Registre du Commerce et des Sociétés (RCS) | inpi.fr / infogreffe.fr |

| Denmark | Erhvervsstyrelsen (Danish Business Authority) – CVR Register | erhvervsstyrelsen.dk |

| United States | Business registration handled at state level | sba.gov |

In addition to researching the company’s background, consider:

- Country-specific payment terms – As well as the broader business situation, pay careful attention to payment terms. In some countries, 90+ day payment terms are considered normal, so you’ll need to decide if you can accommodate that.

- Financial health and trading history – Accessing detailed accounts may be difficult depending on the jurisdiction. But you can often find basic financial information, credit ratings, or reports from international credit reference agencies.

- Company reputation – Search for online reviews on sites like Trustpilot. If the company doesn’t have a presence there, try industry forums, or search for the company or key members of staff on LinkedIn. Don’t hesitate to ask the client directly for trade references from other suppliers. A legitimate business should be happy to provide them.

- Industry and sector research – Understand the client’s industry in their local market. Some sectors are higher risk than others. The UK Department for Business and Trade provides country guides, market information, and advice on doing business in specific regions.

- Credit score – Look for an international credit reference agency: Creditsafe, Dun & Bradstreet, or Experian offer international reports.

At this early stage, you have time to back out of the deal if you spot any red flags or warning signs. One of the biggest red flags is a reluctance to communicate the information you’re asking for.

If you find concerning information that’s not necessarily going to be a deal-breaker, you might want to adapt your terms to reduce your exposure. Consider:

- Requiring payment in advance or staged payments tied to milestones

- Using payment methods designed for international business relationships, like Wise

- Setting shorter payment terms for international clients

- Limiting your initial exposure with a small pilot project

Dealing With Language Barriers

When working with non-English-speaking customers, you will almost certainly meet some language barriers, even if you’re fluent in a second language. When you move away from simple conversational exchanges and into formal business discussions, communication becomes more difficult.

Sometimes, both parties believe they’ve understood each other when actually they haven’t. This can impact:

- Contract terms and obligations – Deliverables, timelines, quality standards, or payment terms

- Scope – Doing more work than you anticipated while your client believes it was always included

- Payment disputes – Confusion about schedules, currencies, amounts, or the process for invoicing

- Quality expectations – Subjective terms like “high quality,” “professional standard,” or “fit for purpose” can mean very different things in different cultures and languages

- Problem escalation – Language barriers can turn small problems into large ones because one or both parties have difficulty explaining what they need.

To mitigate this, we recommend that you put everything in writing. Follow up every phone or Zoom call with a written summary, and ask your client to confirm in writing that they understand and agree. When you write the summary, don’t be condescending, but try to use short sentences with straightforward vocabulary. Avoiding slang or “business speak”.

Where possible, include diagrams, mockups, examples, and visual references. If you’re providing a service, show examples of previous work. If you’re supplying products, provide detailed images and specifications.

For critical documents like contracts, terms and conditions, and detailed specifications, professional translation is worth the investment. In a pinch, DeepL or Google Translate can be useful for casual communication, but neither is reliable enough for anything legally or commercially significant.

Working With International Clients in Different Time Zones

In some cases, there may be zero overlap at all between an international client’s working hours and your own. Time zones can slow down the entire payment process, too. Queries about invoices, approval processes, and payment authorisations all take longer when there’s limited overlap in working hours. And for unscrupulous clients, this can provide the perfect cover if you’re chasing unpaid invoices.

Although it’s tempting to say you’ll do everything via email, consider that this could build in very long lead times to get answers to questions. If you send a query at 5pm UK time to a client in Sydney (11 hours ahead), you won’t get a response until they start work the next morning – which is 10pm for you.

Platforms like Asana or Trello let everyone see project status, updates, and tasks without needing live communication. Your client can check progress in their morning while you’re asleep, and vice versa.

For more complex issues, you’ll need to find a time when you or your client can communicate via Google Meet, Zoom, Teams, or phone, which may mean one or both parties working outside their normal work day. The best way to handle this is to establish an overlap, even if it’s just an hour or two. This is your window for communicating with that client.

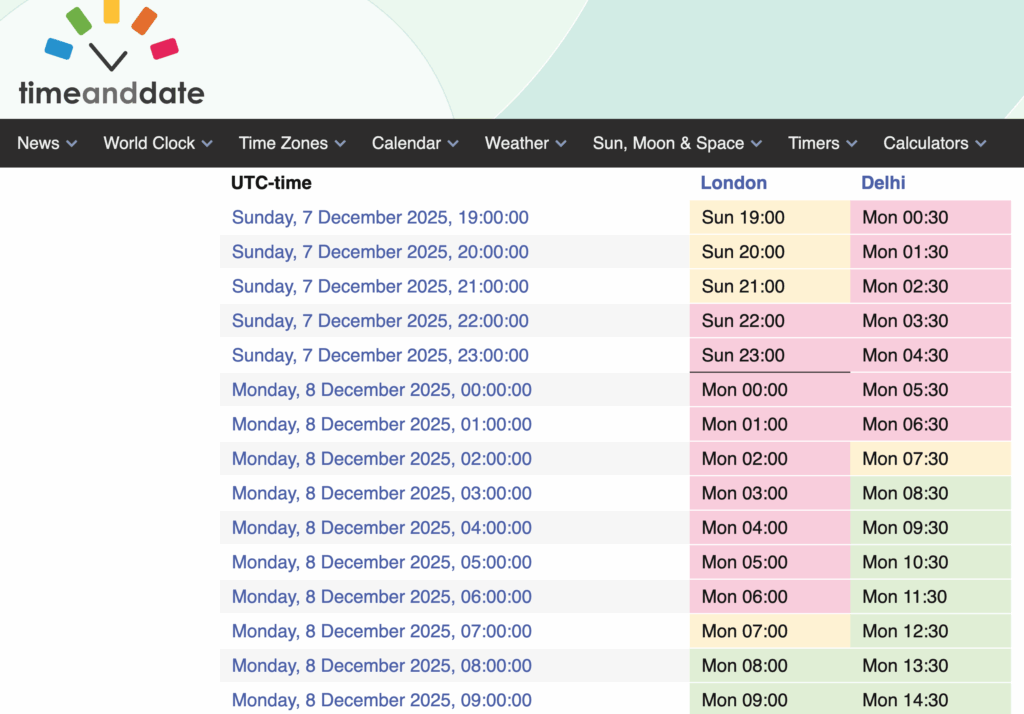

To get a feeling for the overlap you might have, use the Meeting Planner on the Time and Date website to see how the client’s work day compares with yours. If there’s genuinely no natural overlap, agree which party will occasionally flex their hours for important discussions.

For genuinely urgent issues, establish how these will be handled. This might include sharing emergency contact numbers, for example.

At the same time, set some boundaries so the client doesn’t have free rein to wake you up at 3am for something that could wait.

How Much Will You Charge International Clients?

Unless they are in one of very few British territories, it’s highly likely that your customer will be working in a different currency, and this raises a few questions of its own:

- Invoicing in pounds sterling puts the currency risk on your client. You know exactly what you’ll receive (minus any payment processing fees). Your client must handle the conversion and absorb any exchange rate fluctuations between quotation and payment.

- Invoicing in the client’s currency can make you more attractive to international customers who prefer to see prices in familiar terms and know their exact outlay. However, you now carry the exchange rate risk.

If you decide to invoice in the client’s own currency, make sure you are using an up-to-date exchange rate. Exchange rates can shift significantly even over short periods.

If you quote a project at €10,000 when the rate is €1.17 to £1, you’re expecting around £8,547. If the euro weakens to €1.20 to £1 by the time payment arrives, you’ll only receive £8,333 – a loss of over £200 on a single transaction.

For larger contracts or longer payment terms, these swings can seriously impact profitability.

No Cost. No Obligation.

100% Confidential.

If you invoice in the client’s currency, we recommend using current rates from a site like xe.com, but also building in a small buffer of up to 5% to guard against shifts. Further protect yourself by checking the rate every time you invoice and including expiry dates on quotations.

If you have ongoing work or retainer arrangements, include currency adjustment clauses that allow you to review pricing if exchange rates move beyond a certain threshold.

International Payment Processing and Fees

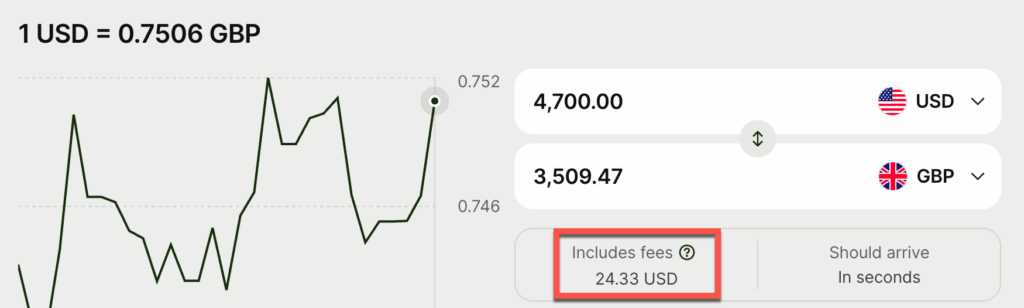

Currency conversion isn’t free, and payment platforms can charge substantial fees for cross border payments.

Direct bank funds transfer may be an option. You will need to supply your customer with your IBAN – International Bank Account Number. This should be clearly displayed in your online banking software, or available by request from your local branch or telephone banking service.

Remember to compare:

- Bank transfer fees from both sending and receiving banks, plus the exchange rate spread (the difference between the buy and sell rate)

- Payment platform fees, which are typical when using services like PayPal, Wise, or Stripe. These are often more transparent than bank fees but can still be substantial

- Hidden costs in exchange rates, because banks and payment processors make money on the spread between what they pay for currency and what they charge you

Some of these fees can be minimised by using the right platform or payment processor. For example, check with your bank to see if they offer multi-currency accounts and compare the cost with something like Wise or Revolut Business.

Be explicit in your terms about who bears payment processing costs. You might absorb these as a cost of doing business, add them to the invoice, or require the client to cover all fees so you receive the full invoiced amount.

Pricing Strategy for International Clients

Beyond currency considerations, think about how you price for international work. International projects often involve more administration, longer communication cycles, potentially more complex contracts, and higher risk. Your pricing should reflect this additional overhead.

We strongly recommend that you build in bad debt provision. International debt recovery requires specialist advice, and while Safe Collections is successful in managing international claims on a “no collection = no commission” basis, you should think about how long it will take and how that might impact your cash flow.

Make sure you know what legislation applies in the country where your client is based, and how that might affect your own chances of getting paid promptly.

Within the EU, most transactions are now subject to 30-day payment terms by default, but this can still be altered through mutual agreement, so read the small print carefully before you sign any supply contracts.

No Cost. No Obligation.

100% Confidential.

What Happens When International Clients Don’t Pay?

If a payment is late or does not seem as though it is going to arrive at all, chasing international debts can be a greater challenge than pursuing a domestic debtor. Often the distance involved, coupled with different legal jurisdictions, can make it seem like an impossible task.

Everything that makes cross-border business more complex becomes amplified when clients won’t pay. Different legal systems, language barriers, distance, time zones, and unfamiliar business practices all make it significantly harder to recover what you’re owed.

Your debtor knows you’re unlikely to visit, may not understand their local legal system, and will struggle with language and cultural barriers. What works for UK debt collection often fails internationally.

Does UK Late Payment Legislation Apply to International Clients?

UK Late Payment Legislation may apply in some situations. However, this is an area where we recommend contacting Safe Collections for a free review of your situation.

If you’d like to calculate the potential interest and fees on the unpaid invoice, you can use our free late payment calculator tool.

Recovering an Unpaid Invoice From an International Client

Rather than trying to navigate foreign legal systems yourself or simply writing off international debts as unrecoverable, specialist debt collection services work with local partners who pursue debts as though they were domestic.

Safe Collections works with collection agents based all over the world, so we can refer your case to a partner in the relevant country, allowing them to pursue it on a domestic basis and making it much more likely that you will get your money back. All of our international debt collection partners are fully conversant in the local language, customs, and legal practices, making them perfectly placed to chase your errant debtors.

If you have an overseas debtor that seems intent on trying to wriggle out of payment, contact us for a free claim review.