Four scammers from East Lancashire were jailed for fraud and money laundering offences in 2016 after using a string of fake debt collection companies to fraudulently obtain thousands of pounds from SMEs to pay fictitious debts.

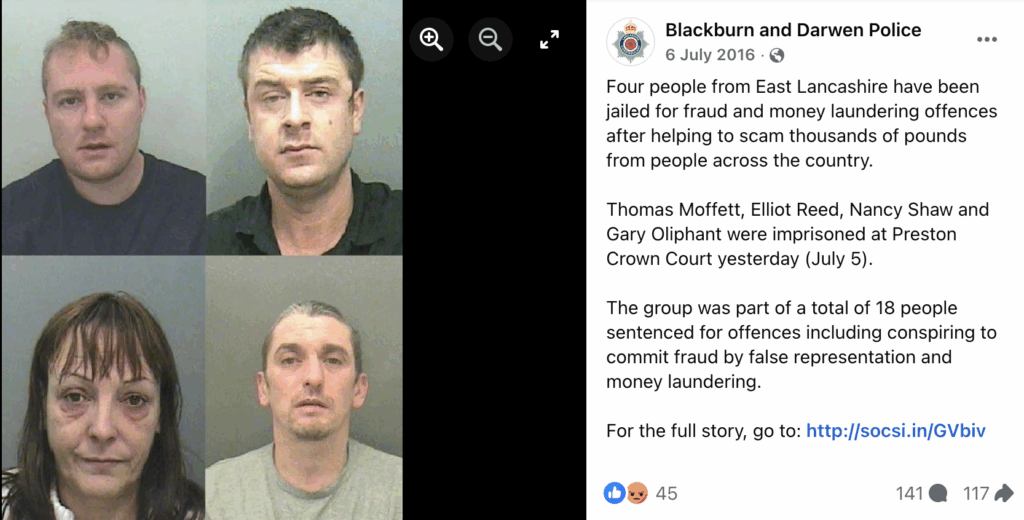

Thomas Moffett, Elliot Reed, Nancy Shaw, and Gary Oliphant were imprisoned at Preston Crown Court on July 5th, 2016.

The group was part of a total of 18 people sentenced for their role in the scam for offenses including conspiring to commit fraud by false representation and money laundering.

Lancashire Police made the arrests following two separate fraud investigations.

No Cost. No Obligation.

100% Confidential.

Table of Contents

The First Investigation

The first investigation involved Thomas Moffett.

The 32-year-old, of Bridge End in Barley, was arrested by police in January 2013 for alleged offences as owner of Moth Communications Limited (company number 07235522, dissolved in March 2020).

Moth Communications Limited was incorporated in April 2010 and operated from Thomas Moffett’s bedroom at a former address in St Aiden’s Close, Blackburn.

During October 2011 to December 2012, Moffett conspired to defraud thousands of pounds from business owners across the country using threatening and aggressive calls to bully small business owners into paying debts they did not owe. The court heard how Moffett allowed £127,000 of fraudulent cash to pass through his bank account.

The court was told how vulnerable businesses were targeted, including elderly owners of bed and breakfast hotels. The victims were told that they owed a debt and it should be paid immediately; otherwise, bailiffs and the police would come to their address and seize property to the value of what was owed, usually several thousands of pounds.

The victims would pay money for the fake debt into his account, and then he immediately withdrew the money to keep the balance in the account low.

When faced with the overwhelming evidence against him, Moffett pleaded guilty in court.

Investigating officers then discovered that Moffett’s offences were linked to a second investigation involving Nancy Shaw, 50; Elliot Reed, 38; and Gary Oliphant, 42.

The Second Investigation

Nancy Shaw, from Pemberton Street, Blackburn, set up a business called The Business Hub Directory Ltd (company number 08250867, dissolved in June 2014.)

Elliot Reed, of Clitheroe Road, established a company called The Business Directory SEO UK Ltd (company number 08090583, dissolved in November 2013).

The court heard Shaw allowed £59,000 of fraudulent cash to pass through her account between September 2012 and August 2013, while Reed’s company took £78,000 from victims between May 2012 and July 2013.

More than a dozen offenders involved in the network allowed their personal accounts to be used to launder the fraudulent money.

Identifying these personal bank accounts along with the business accounts was crucial in order to identify the offenders, including Oliphant.

Oliphant admitted to money laundering and also allowing his home to be used for the purpose of fraud. He confessed he was aware of the scam and was present while some of the apparent debt collection calls had been made. When arrested, he was in possession of a number of phones, SIM cards, and a computer that had been used to research the group’s victims.

When police identified the first victim on the computer, this person was already contacting Action Fraud to report a threatening call they had received.

Det Con Jane Challenger, of Lancashire Police’s Economic Crime Unit, was responsible for the investigation into Moffett. She said:

“This was a sophisticated fraud investigation in relation to a boiler room scam. Victims were bombarded with telephone calls. The calls were threatening and aggressive, stating they owed for a debt and that the payment should be made immediately. Victims felt pressurised to pay the money, some parting with life savings and in other cases being forced to close down their businesses.”

Det. Con. John Banks, of Blackburn CID, responsible for the second investigation with Det. Con. David Gill, added:

“The investigation into Shaw, Reed, and Oliphant was extensive and involved dealing with hundreds of victims throughout the country. The impact on the victims has not only been detrimental financially but also physically and mentally, with some victims losing their businesses and becoming seriously ill as a result of these crimes. It is hoped that these sentences send out a message that these crimes will not be tolerated and the police will do everything in their power to bring the offenders to justice.”

Guilty As Charged

- Thomas Moffett, 32, of Bridge End in Barley, pleaded guilty to conspiracy to commit fraud by false representation and was sentenced to two years and 10 months in prison.

- Elliot Reed, 38, of Clitheroe Road, Whalley, pleaded guilty to conspiracy to commit fraud by false representation and was sentenced to two years and two months in prison.

- Nancy Shaw, 50, of Pemberton Street, Blackburn, pleaded guilty to conspiracy to commit fraud by false representation and was sentenced to two years and one month in prison.

- Gary Oliphant, 42, of Campbell Street, Blackburn, pleaded guilty to conspiracy to commit fraud by false representation and money laundering and was sentenced to two years and five months in prison.

- Marcus Moss, 44, of Vicarage Lane, Wilpshire, pleaded guilty to money laundering and was sentenced to 12 months in prison suspended for two years. He was given 200 hours of unpaid work.

- Reginald Gregory, 53, of Ivinson Road, Darwen, pleaded guilty to money laundering and was sentenced to 15 months in prison, suspended for two years. He was given a 35-week curfew and electronically monitored.

- Samuel Dysart, 22, of Haslingden Road, Blackburn, pleaded guilty to money laundering and was sentenced to 12 months in prison suspended for two years. He was given 280 hours of unpaid work.

- Zak Deaffern, 25, of Ratcliffe Street, Darwen, pleaded guilty to money laundering and was sentenced to 22 weeks in prison suspended for two years. He was given a 26-week curfew and 12 months of supervision.

- Joanne Orr, 25, of Tythebarn Street, Darwen, pleaded guilty to money laundering and was sentenced to nine months in prison, suspended for two years. She was given a 26-week curfew and 12 months of supervision.

- Anthony Lucas-Brewer, 32, of Cavendish Street, Darwen, pleaded guilty to money laundering and was given a two year community order and a £500 fine.

- Lauren Poland, 27, of Marsh House Lane, Darwen, pleaded guilty to money laundering and was given a 26-week curfew and was electronically monitored.

- Bryan Baron, 40, of Moorfield Avenue, Ramsgreave, pleaded guilty to money laundering and was given 170 hours of unpaid work.

- Christopher Hayes, 38, of Selkirk Close, Blackburn, admitted to money laundering and was given a two year curfew, electronically monitored for 20 weeks, and a supervision order of 18 months.

- Coleen Turner, 42, of Douglas Place, Blackburn, pleaded guilty to money laundering and was given a two year community order and a 26-week curfew.

- Gary Brown, 42, of Wood Street, Darwen, pleaded guilty to money laundering and was given a two year community order and 200 hours of unpaid work.

- Michael Middlehurst, 35, of Powell Street, Darwen, admitted to money laundering and was given 12 months in prison suspended for two years.

- Sharyle Connor, 40, of Fawcett Close, Blackburn, pleaded guilty to money laundering and was given a two year community order.

- Kevin McAuley, 35, of Seacole Close, Blackburn, pleaded guilty to money laundering and was given a two year community order and 200 hours of unpaid work.

No Cost. No Obligation.

100% Confidential.

How to Avoid Fake Debt Collection Companies

If you have any doubts that a message from a debt collection agency is genuine, check out our tips to avoid dealing with dodgy debt collection firms.

One easy tip: look up the company on Companies House. Many of the firms implicated in this scam were relatively new at the time the demands were sent.

We also recommend looking up debt collection agency reviews on independent third-party websites like Trustpilot and Google Reviews.

Even though most reviews will be from clients rather than debtors, you’ll quickly be able to get a feel for whether the firm is genuine.