Did you ignore late payment red flags, and now you have an unpaid invoice to deal with?

We understand how frustrating and draining this can be.

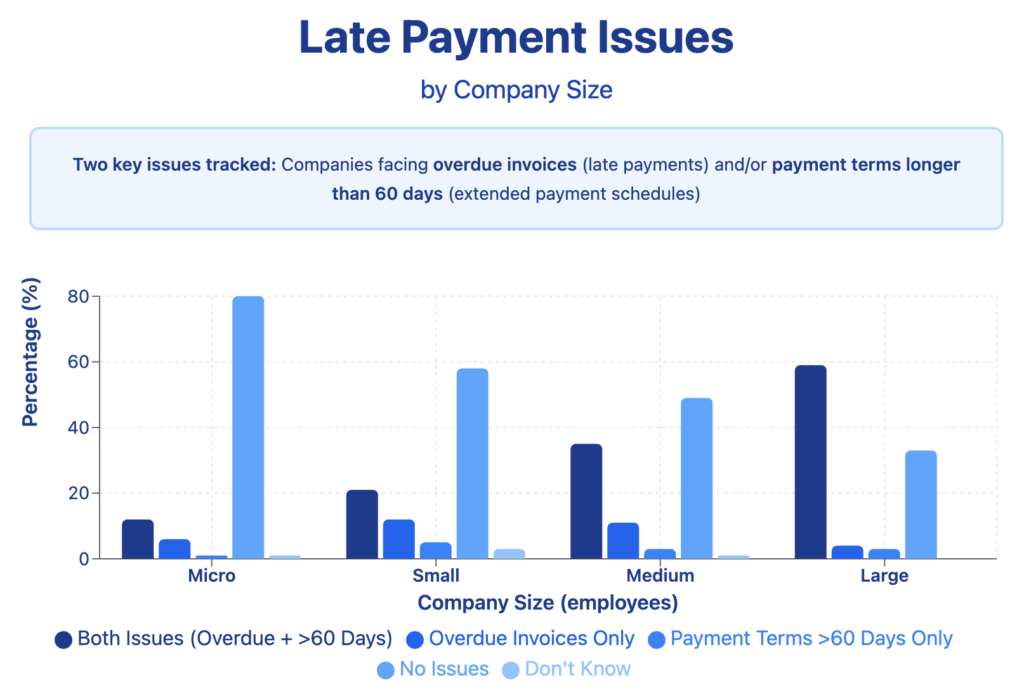

According to the UK government, 38 UK businesses close every single day as a result of late payments.

Late payments can seriously disrupt cash flow, take precious time to sort out, and might even permanently sour relationships with clients.

No Cost. No Obligation.

100% Confidential.

Table of Contents

Why Do Some Clients Pay Late?

Some clients pay late because of genuine reasons. In our experience, most late payments are one-offs. With a little dialogue and a little patience, most can be resolved amicably. But what about that small minority of clients who:

- Persistently pay late?

- Deliberately avoid payment?

Unscrupulous operators do exist, and we all run into them.

According to the Department for Business and Trade, UK companies lose 133 million work hours every single year across the UK economy just chasing payments that aren’t made on time.

Your best defence is to be on your guard and learn to spot the warning signs so you can deal with late payments quickly.

Late Payment Red Flags: Quick Recommendations

| Red Flag | Recommended Action |

|---|---|

| Evasive about payment terms or contracts | Set communication expectations upfront and require signed contracts before starting work. |

| Slow to reply to emails or phone calls | Include response timeframes in contract (e.g., 48 hours) and document all communications in case you need evidence for debt collection. |

| Not interested in building rapport | Address communication issues immediately, but consider if client is committed. |

| No clear payment process outlined | Request payment details before starting and get invoicing procedures in writing. |

| Unprofessional email addresses or no AP contact | Verify business legitimacy and research company online; get multiple contacts. |

| Slow to sign or actively refuses contract | Make contracts non-negotiable, use digital signatures, and treat refusal as a major red flag. |

| Requests unusual payment terms or delays | Stick to standard payment methods and complete negotiations before starting work. |

| Wants to communicate via WhatsApp, Telegram, or non-standard platform. | Keep paper trail via email or project management platforms. Refuse informal channels that are hard to trace. |

| Late changes to agreed payment terms | Lock in terms before detailed work begins. Question excessive focus on payment modifications and halt work until clear. |

| Aggressive price negotiation or excessive time demands | Set boundaries: limit discovery calls and hold firm on rates or walk away. |

| Payment is late, client is not responding | Use our free debt collection letter templates and get a free claim review from Safe Collections as soon as possible |

Let’s look at the biggest late payment red flags in detail.

Your Client Is Not Communicating

Clients who pay late typically don’t communicate well with freelancers or suppliers. That’s if they communicate at all!

Watch out for clients who are:

- Evasive when committing to your terms or signing contracts

- Slow to reply to your emails or phone calls

- Not interested in building a rapport with you

These are not necessarily signs that invoices won’t be paid, but they are red flags. If someone can’t communicate professionally, that should raise questions: if they don’t seem to know what they want, how will you meet their expectations? That’s where problems arise:

- If a client won’t commit to your terms or reply to your emails, they might decide not to pay your invoice because they’ll claim you didn’t meet the brief.

- Clients who don’t communicate might also not be fully committed to what they’ve asked you to do.

- It could also be that the client does not really grasp the value of the work you are doing and will claim they are being overcharged when you send your invoice.

- Lack of communication can be an issue when working with partners or clients who are about to be insolvent: the case of Dark Bunny Tees serves as a warning sign of what can happen.

How to Get a Poor Communicator to Pay Invoices On Time

- Set communication expectations upfront. Every contract should include your requirements for communication. You can provide specific response timeframes (e.g., “Client agrees to respond to project communications within 48 hours”).

- Require signed contracts before starting work. Don’t begin any project until you have a fully executed agreement. Use a platform like DocuSign to get a signature before starting.

- Build in approval checkpoints. Structure projects with clear milestones that require written client approval before moving forward. This creates a paper trail and forces engagement throughout the process. You can also consider invoicing at each milestone to break a large project into smaller chunks. Then, if the client complains, you can pause the project at the first milestone, limiting your losses if they dig in their heels when it comes to paying you.

- Document everything. Keep detailed records of all communications, including sent emails. Keep a copy of all documents you send. This protects you if payment disputes arise because you’ll have evidence for what you did. If clients really push, consider a time tracking platform.

- Address communication issues immediately. If you notice poor communication patterns early, have a direct conversation about expectations. Sometimes inexperienced clients simply need guidance on how to work effectively with freelancers. Other times, clients will intentionally avoid answering your questions so they can negotiate the price down, or avoid paying at all.

Some clients will communicate well throughout the project, but stop responding when it’s time to pay. If you’re in that situation, contact us to discuss next steps.

Your Client Didn’t Outline a Payment Process

If you do not get clear instruction as to where to send the invoice and ultimately who is responsible for payment, that’s a late payment red flag. Expect to be passed from pillar to post when your payment is due.

A professional business will have a good workflow set up for accepting payments. They’ll let you know:

- How to invoice them

- When to do it

- What to include

- Who to send the invoice to

They’ll also confirm that your payment deadlines are acceptable (or negotiate terms if they’re not).

Watch out for signs that the company you’re working with doesn’t take itself seriously. Obvious signs are things like jokey, spam-like email addresses that make you question whether you are dealing with a proper business at all.

But there are more subtle signs, such as a client not having an accounts payable department (or, at the very least, a person responsible for paying who has a phone number and an email address).

How to Verify Invoicing Details to Avoid Late Payments

- Request payment process details before starting work. Ask who handles invoicing, what their preferred format is, required approval workflows, and typical payment timelines. Get this information in writing as part of your project setup. Then do a little research: look on social media and verify that this person is real.

- Verify business legitimacy early. Research the company online. Check their website for professional contact information. Confirm you’re working with decision-makers who have authority to approve payments.

- Get multiple contacts. Ask for contact information for at least one person who manages finances. Having direct access to whoever processes payments eliminates the middleman when collection time comes.

- Include payment logistics in your contract. Specify exact invoicing procedures, required invoice details, submission deadlines, and payment terms. This prevents confusion and gives you leverage if they try to delay payment over “missing information.”

- Test their process with a small project first. For new clients, consider starting with a smaller engagement to evaluate their payment reliability before committing to larger projects. If you can’t do that, ask for a deposit and treat it as a dry run to see whether payment is made on time.

Your Client Was Slow to Sign a Contract

The #1 mistake we see businesses making is not getting terms agreed upon upfront.

And it’s understandable: you might feel like you’ll miss out on work if you ask prospective clients to jump through hoops before you start. For small projects, you may feel like skipping the contract makes sense just to save some time.

But contracts are your main form of legal protection in the event of incidents like non-payment. You should insist on having a contract to protect against late payments.

If a client actively refuses to sign one, alarm bells should ring.

How to Prevent Late Payments With a Contract

- Start with a payment terms discussion. Before drafting the full contract, have an upfront conversation about payment schedules, late fees, and terms. Clients who balk at reasonable payment discussions are likely to cause problems later.

- Make contracts non-negotiable. Signed agreements are a standard business requirement, and any serious business will expect to receive one. Frame it as a benefit for you and the client: “To ensure we’re both protected and clear on expectations, I’ll send over our standard agreement for your review.”

- Create contract templates. We recommend simple, one-page agreements for smaller projects. You don’t need a lawyer to write this up: just include payment terms, scope, and deadlines. This removes the “too much hassle” excuse while still protecting you legally.

- Use contract refusal as a screening tool. If a client pushes back on signing even a basic agreement, consider this a major red flag and a sign that they may not pay you. Professional businesses understand the need for clear terms and won’t resist reasonable contracts. They actually want to pay their suppliers.

- Offer online completion: Use digital signature platforms like DocuSign or HelloSign to make contract execution quick and convenient. Remember to download a copy and store it securely in case your chosen platform has issues.

- Include late payment fees in your contract. You’re protected by law and can simply link to the guidance for your own country.

Your Client Makes Strange Requests Regarding Payments

At Safe Collections, we’ve been helping businesses to recover late payments since 1984. You can probably imagine just how many clients we’ve helped with late payments, and how many truly odd circumstances we’ve come across.

A serious client will not ask for:

- Weird payment terms that involve delaying or postponing payment

- Use of obscure payment platforms

- Dodgy arrangements via WhatsApp or Telegram – which are almost always scams

Another red flag is late negotiations. If a client starts to back off when you’re setting up their contract, you might want to think about why the payments and fees seem so important to them.

How to Deal With Changes That Are Late Payment Red Flags

- Stick to standard payment methods and terms. Accept established payment platforms that are internationally accepted: bank transfers, PayPal, Stripe, and Wise are common.

- Keep a paper trail. Use professional channels like email or project management platforms. Never negotiate contracts or payments through WhatsApp, Telegram, or similar apps.

- Lock in terms before detailed work begins – Complete all contract negotiations, including payment terms, before you start work. Late changes to payment terms, or strange adjustments to agreed contracts, are a huge red flag.

- Question excessive focus on payment details. Professional clients discuss payment terms once and move on. If someone repeatedly brings up payment modifications, delays, or unusual arrangements, step back and evaluate whether they’re planning to pay at all.

You Have a Gut Feeling the Client Won’t Pay You On Time

Gut feeling is sometimes valid.

When you’re new to freelancing or running a business, it’s difficult to get into the rhythm of managing the administrative side of what you’re doing. Working with international clients is especially tricky because there are cultural and language barriers to negotiate.

But after a while, you’ll develop a gut feeling for clients that will work well with you vs. the ones that won’t. That’s your business instinct, and it’s a feeling that you shouldn’t ignore.

It’s difficult to advise on developing gut feeling, but here’s an example.

We recently spoke with a freelancer who held a discovery call with an international client. After investing an hour on the call and several hours on the quote, the client came back and asked for a significant reduction in the cost of the work.

After that, they wanted another hour-long discovery call. With an expanded agenda. And double the attendees.

In some cases, this kind of preparation is justified. But for a low-value, one-off project, our client decided that there were enough red flags to decline the work. They sensibly decided to move forward with a different client.

It’s also difficult to make the right call when your income will be affected. But a client who is picky about costs and demanding of your time is a client that may be best passed along to a competitor. Let someone else deal with that problem and take on the expense of sorting it out.

How to Know When Payment Red Flags are Real

- Set boundaries around your time. Limit discovery calls to 30 minutes and charge for additional strategy sessions. If a client needs extensive upfront work, build that cost into your project fee or charge separately for the consultation phase.

- Trust your instincts when red flags accumulate. When multiple warning signs appear, it’s usually a sign that the same patterns of behaviour will repeat, and that might include nit-picking over invoices.

- See price haggling are a major warning sign – Clients who negotiate aggressively on price often become demanding late payers. Consider holding firm on your rates or walking away when excessive price pressure appears.

- Limit your exposure. Take a deposit or agree to milestone payments.

- Know when to give up. If all else fails, walk away. Sometimes walking away from a customer you aren’t sure can or will pay you can be the most profitable decision.

How to Deal With Late Payments

In 2024, 7% of businesses commissioned a debt collection agency to chase unpaid invoices. 22% spent time chasing invoices themselves. You can use our free late payment letter templates to kick-start the process of chasing the money yourself.

We recommend that you follow up proactively with clients first. Send letters when invoices are past due and pick up the phone to speak to them.

However, there comes a point where you’ll need support to get what you’re owed. That’s where Safe Collections can help.

If you’ve spotted some red flags, or you just have no time to chase, our friendly and knowledgeable credit control experts can start the collection process today and take the weight off your shoulders. Simply fill in our contact form and one of the team will get in touch with you.

No Cost. No Obligation.

100% Confidential.

Frequently Asked Questions About Late Paying Clients

We’ve been collecting debts in the UK and internationally since 1984, and here are some of the most common questions we’re asked.

If a payment is late, should I just be more patient?

Being patient is not a bad thing. Sometimes a client will pay late because of an admin issue or a banking delay on their end. It’s best to be open-minded but proactive.

Some clients are persistently late in paying invoices, and sometimes that’s an intentional decision on their part.

The sooner you know when patience will not work with this particular client, the sooner you can focus on your business again. That means knowing when it’s time to take a harder tack, or even when it’s time to cut your losses and stop wasting your time chasing the payment.

Can freelancers and small businesses use debt collection services for late payments?

Yes. Our debt collection services are suitable for freelancers and small businesses. We can often collect what is owed on a genuine “no collection = no commission” basis, so you won’t face unexpected costs.

We can likely help you with a late payment if it’s:

- Owed from one business to another

- Documented accurately (in the form of a contract, work order, and invoice)

- Undisputed by the person who owes you the payment

If your situation doesn’t quite match, please contact us to discuss your late payment, and we’ll help you if we can.

How much does it cost to collect a late payment?

Typically, fees will be around 5-15% of the amount owed dependent on the claim specifics, but please contact us to discuss this. We’ll always share our late payment collection fees before we start, and there are no fees if we’re not successful.

Can Safe Collections help me collect late payments from my international clients?

Yes, we can. We have a high success rate in international debt recovery.

Please get in touch to discuss collecting a late payment from a client outside the UK.