Are you looking for a free template letter to chase a late payment?

We have 3 free late payment letters that you can download, customise, and email or post to the company that owes you money.

| Letter | When to Send | How to Send |

|---|---|---|

|

Letter 1:

The Nudge

|

When past due | Post or email |

|

Letter 2:

The Firm Reminder

|

+1 week | Recorded delivery or email. |

|

Letter 3:

The Final Demand

|

+2 weeks | Recorded post and email. |

| If no payment has been received one week after your final letter, contact Safe Collections to start recovery. | ||

Table of Contents

No Cost. No Obligation.

100% Confidential.

Free Late Payment Letter Templates to Download

Our free debt collection letter templates are free and proven to work. Review the list below to find the letter you need in order to chase any debts that are past due.

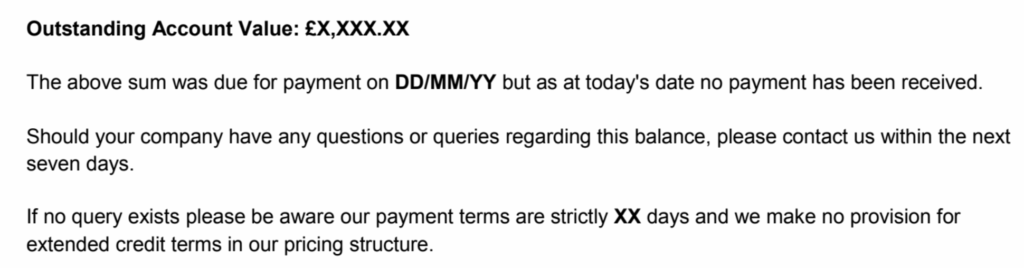

Letter 1: “The Nudge” Letter Template

This is the first overdue payment letter you should send, and we recommend acting quickly once your debt is past due.

Download the letter here:

Letter tone: Gentle reminder

When to send it: Send this letter the day payment is past due so your clients know you take your credit management seriously.

How to send it: By post or email. For the former, standard mail service is fine. For the latter, request a read receipt or delivery notification.

Credit control tip: Make sure you have the correct physical or email address and you are sending your reminder to the right person.

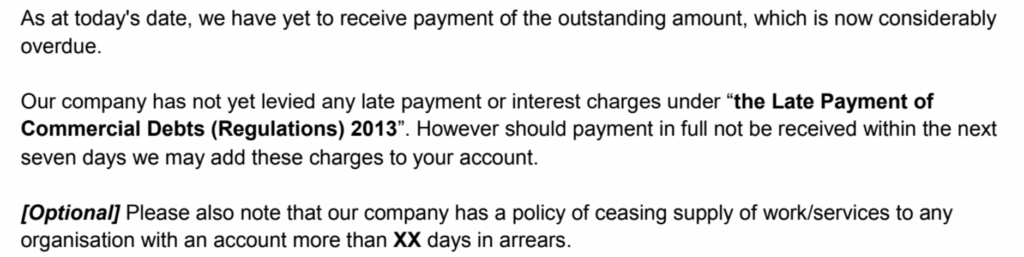

Letter 2: “The Firm Reminder” Letter Template

This is the second letter for outstanding payment. Send this if you don’t have a reasonable response within a week of sending the first one.

Download the letter here:

Letter tone: Serious

When to send it: Letter one allows your client a further seven days to make payment. If a week goes by after delivery of the first one, and you still haven’t been paid, it’s time to send letter 2 and remind your client that you mean business.

How to send it: Post or email. If sending by post, consider using Royal Mail Signed For in the UK, or the International Tracked service if your client is outside the UK. If using email, turn on delivery reports or read receipts before sending.

Credit control tip: Give your client a further 48 hours and then give them a call. When you actually speak to your customer, you will emphasise the fact that you expect to be paid.

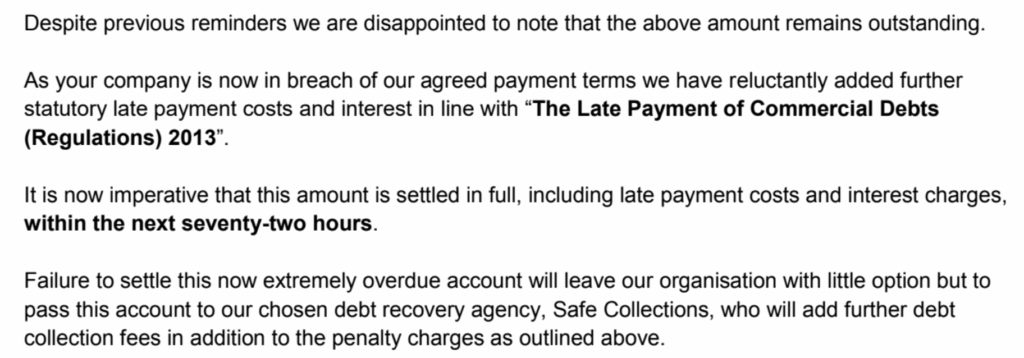

Letter 3: The Final Demand (With Penalties)

Download the letter here:

Letter tone: Final

When to send it: If another week has gone by after letter 2, and your client still hasn’t paid (or made sensible arrangements to pay), then it’s time to “up the ante” and start adding late fees and interest with this template. You’re legally entitled to impose these costs on any overdue B2B invoice. If the client complains, remind them of your agreed credit terms and statutory rights.

How to send it: Signed For post and email, or International Tracked. You’ll get a tracking number at the post office, and your client will know you mean business.

Credit control tip: Follow up this demand with a final call requesting payment. Be sure to impress upon your client that they are overdue and that your company expects prompt payment. Be prepared to drop the late fees and charges in return for an immediate electronic payment, but do not accept any further delays. These serve only to increase the risk you will be left unpaid.

What to Do If You Don’t Receive Payment

After 3 late payment letters, you should expect to have payment, or a reasonable timeline for next steps.

If your client has not paid, contact us to discuss debt collection on a “no collection – no commission” basis.

No Cost. No Obligation.

100% Confidential.

Frequently Asked Questions: Late Payment Reminders and Letters

Many businesses and freelancers ask questions about late payment letters, and here are the most common ones we’ve answered recently.

When Should I Send a Late Payment Letter?

Send a late payment letter as soon as your invoice is past due. If you didn’t agree any payment terms, 30 days is standard.

You can also look at our list of late payment red flags if you’re concerned that your creditor isn’t communicating with you and your payment might be late. This can help you to be prepared so you can send your past due notice immediately.

Is It Worth My Time Sending Late Payment Letters?

Yes. The longer you leave it, the less likely it is you’ll be paid.

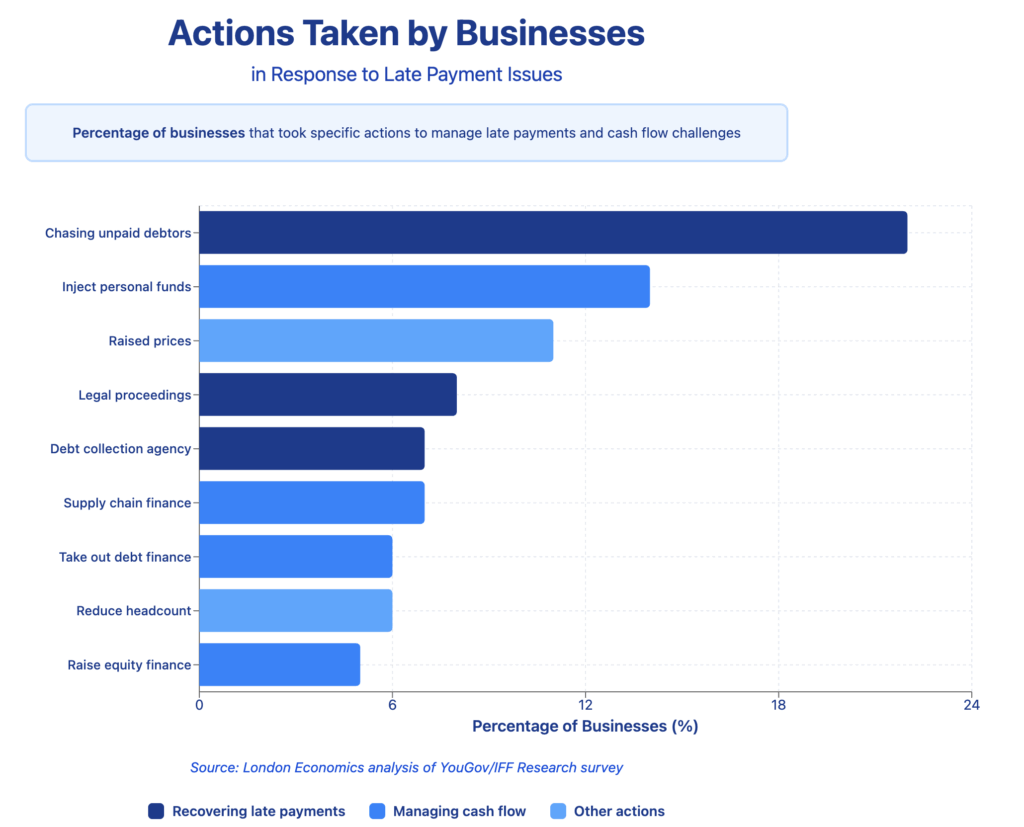

Late payment is a constant problem for businesses in the UK and overseas. Credit terms are ignored and following up can be difficult for some companies, especially if you are a very small or micro business.

When the UK government surveyed businesses in 2024, 22% said their staff were spending time chasing invoices that were not paid on time.

This is not how it should be. Every business, irrespective of size, should expect their customers to honour the agreed credit terms and pay in full and on time.

Consider how long it’s taking you to be paid and how much time you’re wasting sending letters and chasing the debt. Make a decision to send a letter when you have enough reason to act.

If you’re unsure as to whether you’re right to send a letter, you can contact us for advice.

What Are the Risks of Sending Late Payment Letters?

The main risk of chasing a late payment is that you’ll sour the relationship with your client, which may impact your ability to get more work in the future.

Before you start hitting your errant customers with penalty charges and debt collection notices, you need to ensure that the late payment is not just a simple misunderstanding.

If it is a simple mistake on the client’s part, immediately treating them as bad payers is unlikely to endear you with the accounts payable department.

If you’re confident that it’s time to send a letter, our templates are designed to be firm, but polite. We start with a gentle reminder and build up to a formal final demand that outlines the applicable late payment penalties.

Can I Charge Late Fees and Penalties?

Yes, often, you will be able to charge extra for late payments. Read our guide on how to calculate late payment penalties.

Late payments have been addressed by successive governments, who have enshrined statutory penalties for late payment in UK law. Most recently with the Late Payment of Commercial Debts (Regulations) 2013.

This statutory instrument gives every UK B2B business the right to add:

- Fixed costs

- Interest

- Reasonable debt recovery charges

We can advise you on this if you’re not sure what to charge.

What Can I Do If Late Payment Letters Don’t Work?

If your late paying client still hasn’t made payment after receipt of your final demand, it’s time to take action.

We recommend that you compare debt recovery services immediately.

Look for a debt recovery agency that:

- Offers “no win, no fee” debt recovery (or, as we prefer to say, “No Collection = No Commission”)

- Doesn’t charge upfront

- Won’t charge hidden fees

- Has a proven history of recovering unpaid invoices

- Collects debts internationally if your client is overseas

Our debt collection services require no advance payment, we don’t charge any hidden fees, and we have been trading non-stop since way back in 1984.

We successfully collect debts in the UK, and we can also recover international B2B debts.

If that wasn’t enough to convince you, we are also the only debt collection company to be recommended by Crunch Accounting, IPSE, The Publishers Association, Halton Chamber of Commerce, and many more reputable organisations.

How Do I Calculate Late Fees?

Use our late payment fee calculator to work out how much you’re owed.