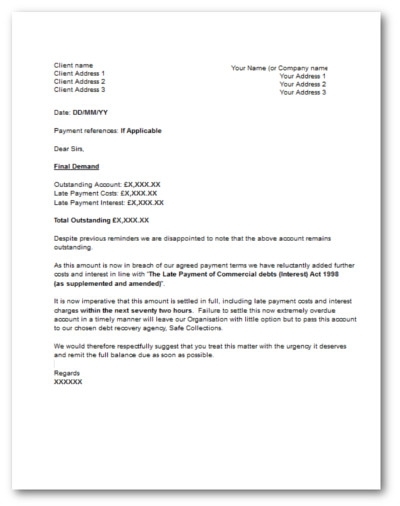

When you have an unpaid invoice, it can be difficult to know how to handle it especially if you are a small or micro business. Profitable business relationships are built on personal relationships so it can feel tricky to pursue what is owed without damaging the relationship.

But business is business and you are doing nothing wrong in expecting prompt payment from your customers and by chasing your money if they fail to pay as agreed. So what is the process for chasing up an unpaid invoice?