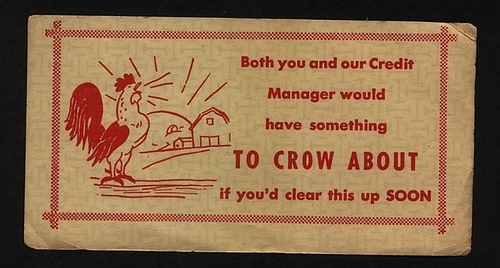

Small to medium-sized enterprises (SMEs) are struggling to tackle late payments from clients who, in the worst instances, miss three or more invoices per year.

Almost half (47%) of SMEs surveyed by Barclays said that their least reliable customers fail to pay on time at least three times each year.

Read more: SMEs Hit by 'Repeat Offending' Late Payment Three or More Times a Year