Dark Bunny Tees Ltd. was a small T-shirt and merchandise printer and vendor based in Norfolk, UK. It was established by Alex Chenery in 2009 and entered liquidation in 2018.

Safe Collections was contacted by a number of creditors in relation to the company.

Even down at the ‘grassroots’ level of microbusinesses and one-man-bands operating in niche cottage industries, where the principles of trust and your word being your bond are still believed to hold sway, things can go wrong.

No Cost. No Obligation.

100% Confidential.

Table of Contents

What Happened to Dark Bunny Tees?

Dark Bunny Tees had a large and positive presence on social media, with licensing agreements to make and sell merchandise on behalf of a number of filmmakers and podcasts.

Having recently moved to new premises and boasted about their swift expansion, the company appeared to be a well-run and successful micro-business.

- In early 2018, Dark Bunny Tees disappeared down the rabbit hole after an extended sale. Its website and social media accounts were shut down overnight with no explanation, and rumours started to swirl on social media about customers not receiving items they had ordered.

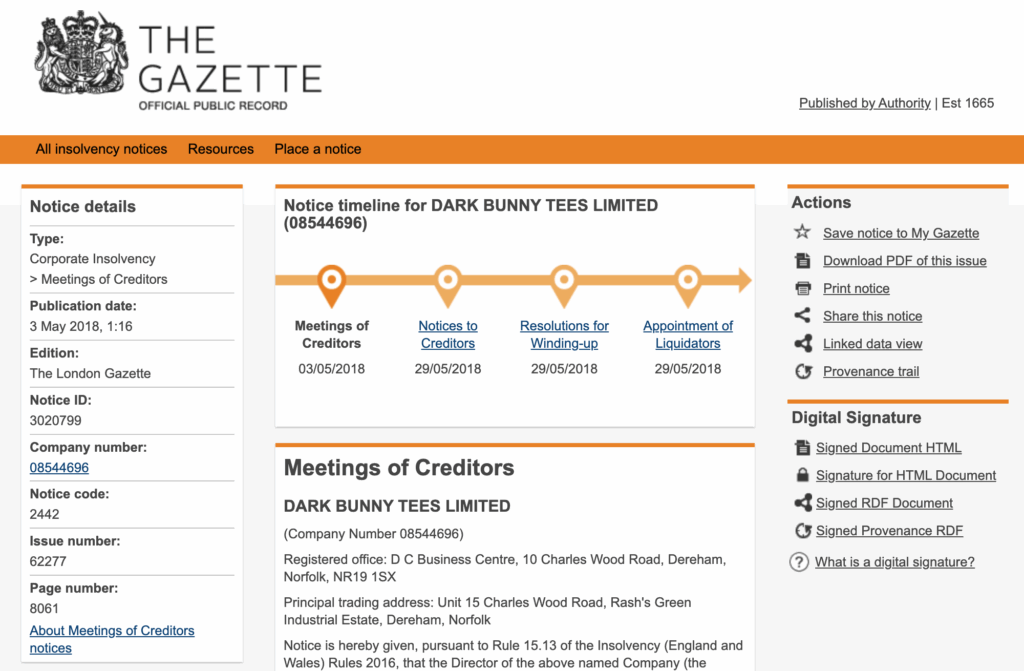

- In May 2018, a notice in The London Gazette confirmed that the company had voluntarily entered liquidation.

- In October 2019, the company was dissolved.

Further searches showed that Dark Bunny Tees has been sued in the county court twice, presumably by creditors of the business, once in March 2018 for £6,004 and again in May 2018 for £4,553. Further to this, some information we have seen suggests the company may owe up to a whopping quarter of a million pounds to its various creditors.

Unfortunately for most creditors, the writing on the wall suggests that most of them won’t be getting much back.

The Impact of Insolvency on Small Businesses

One of Dark Bunny Tees’ creditors is Richard Littler, the freelance genius behind the popular satirical blog Scarfolk.

Richard had never sought to monetise the blog through advertising, subscriptions, or donations. Instead, he decided to go down the route of selling some merchandise.

He entered into a licensing agreement with Dark Bunny Tees, who, according to all reports, did a very brisk trade in Scarfolk T-shirts, sweatshirts, and mugs.

Richard, however, never received any payment at all for any of the merchandise sold by DBT, and he faced an uphill battle to recoup what little he could from the failed business. He set up a Go Fund Me page to try and cover his losses.

Signs Your Client or Partner is About to Go Bust

It’s important to spot the signs of trouble with a client or partner.

No matter how small, niche, or friendly your industry is, your business partners and suppliers financial woes can rapidly become your financial problem.

We recommend looking out for late payment red flags, including delays in making payments, repeated excuses, and poor communication.

What to Do If a Client or Partner Is Insolvent

If a client is insolvent or has entered administration, your chances of recovering what you are owed are low. But the earlier you escalate your claim for payment, the more likely you are to succeed.

Safe Collections has been recovering B2B debts since 1984. We have success in collecting from UK firms and also provide comprehensive international debt collection services.

Contact us today for a claim review or credit control consultancy. We’ll make your enquiry a top priority.

Updated 08.10.18: An earlier version of this article erroneously stated that Dark Bunny Tees Ltd had been sued once for £6000 in March 2018. We are happy to correct this error and can confirm the company was in fact sued twice.