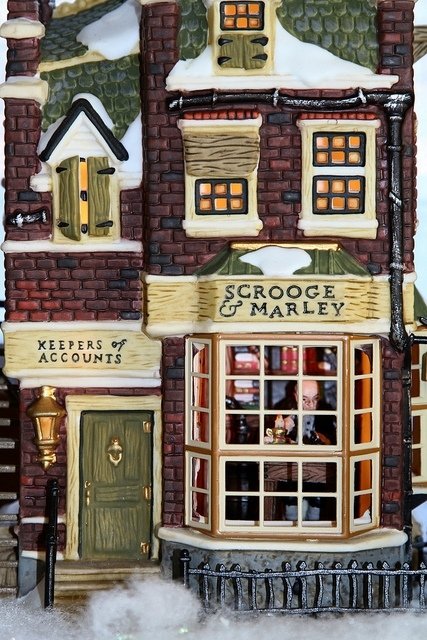

A Christmas Collection

The payment was late: to begin with. There is no doubt whatever about that. This must be distinctly understood, or nothing wonderful can come of this story I am going to relate.

Once upon a time - of all the good days in the year, on Christmas Eve - old Scrooge sat busy counting his unpaid invoices.